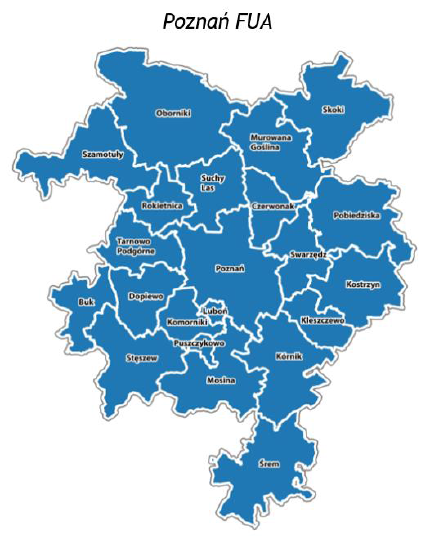

POZNAN FUA

Objectives

• decrease of congestions and air pollution

• holistic analysis of the condition and quality of freight transport distribution

• definition of critical flow disturbance points for freight transport

The territorial context:

• Poznań FUA involved 22 municipalities

• 3 082 km2 – Poznań FUA area

• 1 022 844 – Poznań FUA number of inhabitants

• 177 865 - Poznań FUA number of the employers

• Surveyed area - City of Poznan

• 259 km2 – City of Poznan area

• 532 346 – City of Poznan population

• 25 328 - number of the employers

• 5 city zones used in the tool and in the o/d matrix

The area of the survey is the most logistically inconvenient area within the Poznan FUA due to a major problem with supplies within the city’s area

In the selection of the division criteria, a significant factor was the comparability of sizes and of amounts of population of the particular districts so that

they could be compared easily. The adopted variant is the most optimal of the possible divisions despite differences in sizes and populations of the zone

Results generated by the tool application

Survey sample – 302 companies

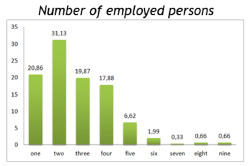

Number of employed persons

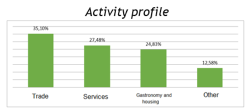

Activity profile

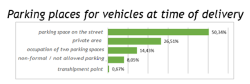

parking places for vehicles at time of delivery

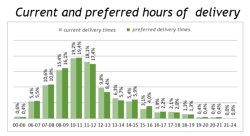

Current and preferred hours of delivery

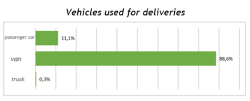

Vehicles used for deliveries

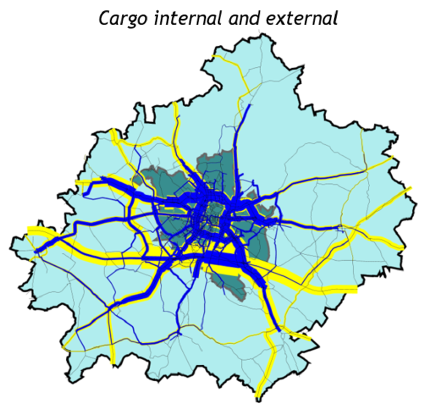

Cargo internal and external

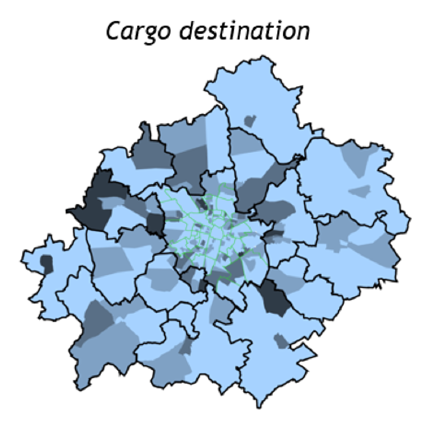

Cargo destination

Freight Quality Partnership

• Public steakholders: Poznan City Hall, Municipal Road Authority, Urban Transport

Administration

• Private steakholders: Agamat, Marol (Chata Polska), Eurocash, Papukurier,

PointPack.pl, Transmeble, Jeronimo Martins, Rentis, Volkswagen Poznań, Dachser, DHL

Parcel, VEMAT, Pol-Bus, GLS

Objectives

• Support for Poznan City Hall in formulation of SULP

• Establishing platform for cooperation between FQP participants

• New pilot projects in urban freight transport

• Unloading bays

• Interactive roadmaps for drivers

• Regulations for deliveries (SULP)

• Contribution to policy / strategy development

Private stakeholder engagement results

• 2 meetings of the FQP group

• Brainstorming session

• First selection of the most interesting topics for FQP participants

• Involvement of the very active private stakeholders like Volkswagen Poznań

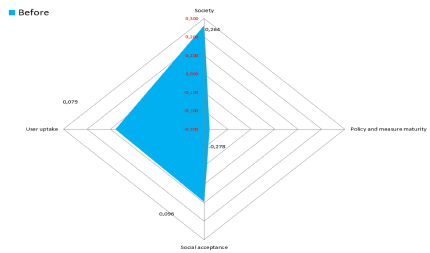

Logistics Sustainability Index (LSI)

Impact Areas:

- society

- policy

- social acceptance

- user uptake

Data interpretation

• The vast majority of the surveyed entities have a small number of employees, which may be

due to the specific nature of the analysed industries and result of the Poznan enterprises

structure. There is no difference in terms of employment compared to other surveyed

companies from gastronomy and hotel sectors

• Most companies have 1 main supplier. Every 3 indicates 2 suppliers, and only 13% of the

surveyed entities have 3 suppliers. In a sense, this situation illustrates the level of

dependence of major suppliers of goods

• Most deliveries are made at least a few times a month, with one third of the companies using

more frequent deliveries, which may be due to very limited warehouse space

• Delivered goods are usually imported in boxes and cartons. The declarations of the surveyed

companies show that the delivery is generally short (up to 10-20 minutes) and the delivered

goods do not exceed several tens of kilograms

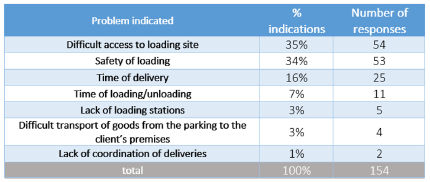

• Among the most frequently reported supply problems, respondents indicate difficulties in

accessing loading and unloading sites. The sense of security of the goods suffers from that

and delivery times are prolonged.

To read more information about Poznan FUA click here